Learn how to choose the best fintech developers who can help you scale securely and efficiently.

Reach out to our specialists now.

Fintech app development has introduced a shift in the generation of the financial service system, changing how people interact with or plan to attend to money matters. Be it using mobile banking or digital wallets, fintech applications have enriched financial services, making them easier, more convenient, and more efficient. Not only has it made basic banking activities faster and easier by automating them, but it has also brought in new forms of financial products and services.

It can be a daunting challenge to find and choose the right fintech app development company. Let’s dive deeper to understand key factors to look for when searching for your app development company. The company you choose should not only provide the basic requirements, they should also ensure your app is secure, follows regulatory guidelines and laws, is fully compliant, whilst maintaining an eye-catching design and user interface. Your selection of an app development partner is the fundamental question to achieving long-term success and staying ahead of the game in this highly competitive field!

Fintech mobile app development can be described as the development of a mobile application that often includes the creation of an offer that covers a set of financial products and services. Such applications are meant to optimize, dematerialize, and enhance financial transactions and processing, from mobile banking and payment systems to portfolio and money management apps. The scope of the fintech app is wide, and it can consist of various services and solutions aimed at both individual consumers and businesses.

Here are a few of the key areas:

Understanding fintech app development is key to businesses that want to use technology to improve their services. That’s where a partner can help with expertise and resources to build fintech apps.

Fintech app design plays a crucial role in the success of financial applications. The visualization or the interface design is considered to be the most important factor that affects the success of fintech applications. The idea of a well-designed app not only includes the ability to attract individuals to download it but also their subsequent retention and satisfaction.

The design process focuses on two main aspects: User Experience (UX) and User Interface (UI). The terms may be confusing as they may be used interchangeably, but they, however, hold different meanings.

User Experience (UX) Considerations

UX, or User Experience, in simple terms, is defined as a smooth, pleasant, easily understandable, problem-solving, and visually appealing application. Key UX considerations for fintech app design include:

User Interface (UI) Design Best Practices

User Experience/User Interface (UX/UI) design specifically relates to the visually aesthetic part of the application and the objects that are touchable by the end-users. Best practices for UI in fintech app design include:

Application design is a significant component of a fintech app. Even though business apps should meet the needs of the audience, it is vital to consider UX and UI standards and study successful cases to create highly valuable and enjoyable applications.

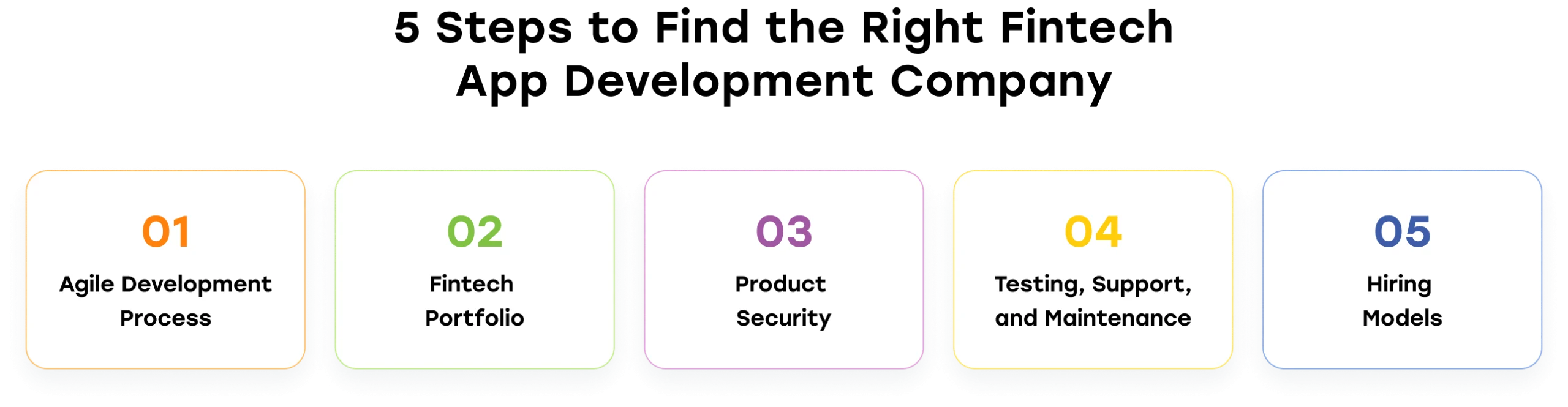

Selecting the right company for fintech app development is crucial to the success of your financial application. Below we have highlighted the 5 main factors we believe are essential to finding the best app development company:

The agile development process is key to successful fintech app development. Look for a company that is flexible, collaborative, and iterative. This way your app will evolve with the market and user needs. By choosing an agile development partner you get more transparency. You also get faster time-to-market and higher chances of delivering a product that resonates with your target audience

A company with a strong portfolio is generally a sign of their expertise and experience in the industry. Make sure to evaluate their track record of fintech app development projects. Also try to understand the complexity, scale, and scope of their previous work. A diverse portfolio will give you a better understanding of their ability to handle different fintech niches. This may include payments, lending or wealth management. By choosing a partner that has proven track record of delivering projects you can be more confident your app is in good hands

In fintech security is key. Look for a development company that puts data protection first. They should follow industry standards like PCI DSS and GDPR. Ask about their security protocols and encryption methods. Ask about their penetration testing. A solid security framework protects your users’ sensitive financial data. It builds trust in your brand. By choosing a company with strong fintech app security you reduce risks and protect your reputation

A testing, support, and maintenance plan is key to the long-term success of your fintech app. Make sure the company offers full testing services. This includes functional, performance, and security testing. Also, ask about post-launch support options. This includes bug fixes, updates, and customer support. A good partner will provide ongoing maintenance. This will keep your app running smoothly and address user needs. This will give user satisfaction and help you build a loyal customer base

Consider the different hiring models offered by the development company. Evaluate whether you need a dedicated team, a project-based approach, or a combination of both. Discuss the company’s talent acquisition process, employee retention rates, and communication channels. A strong team with the right skills and experience is crucial for the successful development of your fintech app. By carefully considering your project requirements and the company’s hiring models, you can select the best approach to meet your needs.

Fintech app development costs can vary significantly based on several key factors. First, the complexity of features plays a crucial role. Incorporating advanced functionalities such as real-time data processing or artificial intelligence (AI) integration can substantially increase development costs. Similarly, the quality of the design influences expenses. High-quality, custom user interface (UI) and user experience (UX) designs, which contribute to a more engaging and intuitive app, can also drive up costs.

Regulatory compliance is another important consideration. Ensuring that the app meets financial regulations and adheres to security standards may require additional resources. The location of the development team can also impact costs. Typically, offshore development services are less expensive compared to local services due to differences in labor costs.

When comparing costs between different fintech app development services, it is essential to assess both the rates charged by service providers and the inclusions of their service packages. Understanding the cost structures, including any ongoing expenses and post-launch support, will help in making a well-informed decision.

Customizable fintech apps offer several significant advantages. They allow for tailored features that meet specific business needs and user preferences, which can provide a competitive edge by offering unique functionalities that distinguish the app from generic solutions. Customizable apps are also more scalable, meaning they can easily adapt to growth and changing requirements.

Flexibility in integrating new features and updates is another critical benefit. A well-designed fintech app should support seamless feature updates to keep pace with evolving market demands. Additionally, compatibility with third-party services and financial institutions through API integrations enhances the app’s functionality.

Examples of tailored fintech app solutions illustrate these benefits. For instance, Chime, a neobank, provides customizable features such as savings goals and automated budgeting. Similarly, Plaid offers flexible APIs that integrate with a wide range of financial institutions, enabling diverse fintech applications.

A fintech app developer should have a wealth of experience and possess a variety of qualities. Technical proficiency is a fundamental skill, but they also need to have expertise in programming languages, frameworks, and specific financial technologies. A bonus is having a solid understanding of financial regulations in different countries.

At some point in the design and development process obstacles and issues will certainly arise. An app developer needs problem-solving skills, and the ability to address complex challenges whilst creating innovative solutions.

Continued education and training is something you should look for in your dev. Additional training and qualifications, participation in conferences, and workshops are essential to stay updated and ahead of the game!

Industry certifications are key to verifying the skills of fintech app developers. Certifications like CISSP validate security practices and CEH validates skills in identifying and fixing security vulnerabilities.

Compliance with financial regulations and standards is also important. Following GDPR ensures data protection and privacy and PCI DSS ensures security for card payments. Understanding and following these regulations helps to reduce legal risks and build trust by showing you care about user data and industry standards.

Choosing the right fintech app development company is key in the fintech world. As fintech changes how financial services are delivered and experienced, the company you choose will make or break your app.

From understanding the intricacies of fintech app development to robust security, seamless user experience, and regulatory compliance, your development partner must show expertise and reliability. Look for a company with a portfolio, agile development, and a focus on both security and user-centric design.

Cost, customization, and flexibility are also important as these will impact the long-term viability and competitiveness of your app. A partner who offers testing, support, and maintenance will ensure your app stays functional and relevant in a changing market.

When it comes to selecting the right partner for fintech app development, your choice will set the tone for innovation, user satisfaction, and business growth in the fintech space.

Partnering with Digicode means tapping into a wealth of fintech expertise. With a strong focus on security, user experience, and compliance, Digicode ensures your app is built to thrive in a competitive market. Our agile approach and commitment to excellence make our team the trustable partner to bring your fintech vision to life, keeping you ahead of the business curve.

What should I consider when choosing a fintech app development partner?

Look for a partner with a strong portfolio in fintech, expertise in security and regulatory compliance, and a focus on delivering seamless user experiences. Agility in development and ongoing support are also key factors.

How important is security in fintech app development?

Security is paramount in fintech app development due to the sensitive financial data involved. Your development partner must implement robust security measures to protect user information and ensure compliance with financial regulations.

Why is regulatory compliance crucial in fintech apps?

Regulatory compliance is essential to avoid legal issues, protect users, and maintain trust. A knowledgeable development partner will ensure your app meets all relevant regulations, keeping your business safe from potential penalties.

What are the benefits of an agile development approach for fintech apps?

Agile development allows for flexibility and quick adjustments during the development process, ensuring your app can adapt to market changes and user feedback, leading to a more refined and competitive product.

How does partnering with Digicode enhance my fintech app’s success?

Digicode’s deep fintech expertise, focus on security, and agile development process ensure your app is built to meet current demands and future challenges, positioning your business for long-term success in the fintech space.

Related Articles