Empower Your Business with Intelligent Digitalization for Informed Decision-Making With Digicode.

Unlock Potential With Digicode!

In the dynamic realm of business, adapting to the winds of change is not just a necessity; it’s a strategic move.

In this era of relentless technological advancement, businesses that navigate the path of digital transformation emerge as leaders. One such story unfolds with Digicode, a trailblazing force in reshaping how companies operate in the digital landscape: we created a customized algorithm for the company, focusing on optimizing information, streamlining processes, implementing a paperless workflow, and facilitating the transition from a desktop version to a web application.

The grandeur of digital transformation extends beyond optimization; it opens doors to a new business model. Consider the scenario – digitizing processes from intake to execution, reducing error rates, enhancing customer attractiveness, increasing transactions, and cutting costs. This isn’t a sprint, it’s a marathon, along with understanding and respecting the client’s tolerance for change.

Traditionally, many American companies have relied on traditional business models.

For such companies, two key factors highlight the necessity of embracing digital transformation: the risk of becoming outdated and gradually being phased out of the market, despite being stable all these years.

At the heart of the story lies a company intricately woven into the fabric of financial transactions, navigating the balance between loans and dealer interactions. Picture a scenario where financial companies offer loans to facilitate substantial purchases, while dealers submit requests detailing customer information and tax amounts. Now, enter Digicode – the reliable partner to transform the system into digital data for seamless, secure, and efficient digital operations.

In the scenario of our collaboration, we encountered the challenge of technological obsolescence and outdated human resources. Consequently, we commenced our efforts well before the Covid-19 pandemic, recognizing the growing urgency for companies to transition to digital platforms.

Furthermore, a significant psychological issue is the stress associated with the transition to digital, the fear of data loss, and the apprehension of coping with the learning curve of new processes. However, digital transformation is needed for all companies of any size, but it is particularly relevant for small businesses to stay competitive and thrive in the market.

At Digicode, we don’t just provide solutions; we tailor them to fit the specific needs of our clients.

Let’s underscore why embracing digital evolution is not just a choice but an absolute necessity, especially in the financial market niche:

Security isn’t just a checkpoint; it’s a journey we undertake with our clients. As the client built its proprietary system to record transactions, time took its toll, ushering in the inevitability of technological aging. The attempt to rewrite the system on new technology was a pivotal moment. Here, Digicode stepped in, offering insights on modernization while respecting the client’s conservative approach to maintaining operations on the existing system.

Digicode’s strategic partnership with financial institutions dictates specific approaches to carefully find the most suitable options for this conservative system.

In a highly regulated setting, innovative solutions are essential. Access to production is restricted to a select few within the financial company to ensure code security and overall stability. External security experts are also involved in this process. Our experts conducted a continuous static code scan, scrutinizing every line for vulnerabilities in accordance with the terms and conditions of the financial institution.

Collaborating with a contracted security consultant enabled our team to meticulously review each step before implementing the integration of digitalization into the company’s daily operations.

The onset of the Covid-19 pandemic becomes a catalyst for transformative prowess. The manual, time-consuming workflows of the financial company, once reliant on physical paper processes, undergo a rapid metamorphosis. The proposal to digitize and establish a paperless process not only addresses the challenges posed by Covid-19 but also positions the company for relevance in the digital age.

Strategic Technological Time Capsule:

Delving into the multi-stage nature of digital transformation, Digicode introduces the concept of a Digital Twin, transforming manual processes into a digital workflow.

The process of creating a Digital Twin is the most optimal solution for conservative companies, as it is an analog process that runs parallel to the old model of process management. The security of such an approach lies in the fact that, together with the customer, we go through all the processes until they are certain that everything is safe and in order.

The benefits extend beyond simplification to fostering a distributed team, remote collaboration, and significant time savings. The emphasis on automation, with 80% automated processes with verification only, illustrates the efficiency gains achievable through digital transformation.

Also, the journey toward digital transformation is nuanced and marked by multiple stages. It’s a process of unraveling complexities, often hidden in the folds of manual processes.

Digital transformation, as facilitated by Digicode, goes beyond being a mere business process. It permeates other departments, enhancing the effectiveness of finance and payment processing.

Digicode transformed business processes into a digital workflow, simplifying, accelerating, and minimizing errors – a testament to the power of a distributed team.

Our proposition extended beyond mere process optimization. We proposed a shift in customer interaction – no more faxes or emails. Instead, we advocated for API online access, reducing errors and returning results to clients in digital format. The metamorphosis wasn’t confined to a single department; it rippled through the organization, making finance more effective and streamlining payment processes.

The potential for reducing error rates, increasing customer attractiveness, and boosting transaction volumes highlights the profound benefits of a fully digitalized business model.

The collaborative advantage of our resources eliminates the dependence on in-house consultants, optimizing task implementation.

Competitor pressure, technological evolution, changing customer demands, and legal adjustments emerge as key catalysts for conservative companies, emphasizing the inevitability of digital transformation.

Digicode’s arsenal includes combinatorial algorithms, automating processes that were once sorted manually. In the realm of digital transformation, psychological shifts are as crucial as technological ones. Old thinking is challenged, and ideas flourish as a company connects with its digital self.

As we journeyed together, compliance requirements evolved, and Digicode played a pivotal role in navigating the changing landscape. From static code scans to mitigating risks, our approach ensured not only compliance but also a strategic advantage.

And the story isn’t unique.

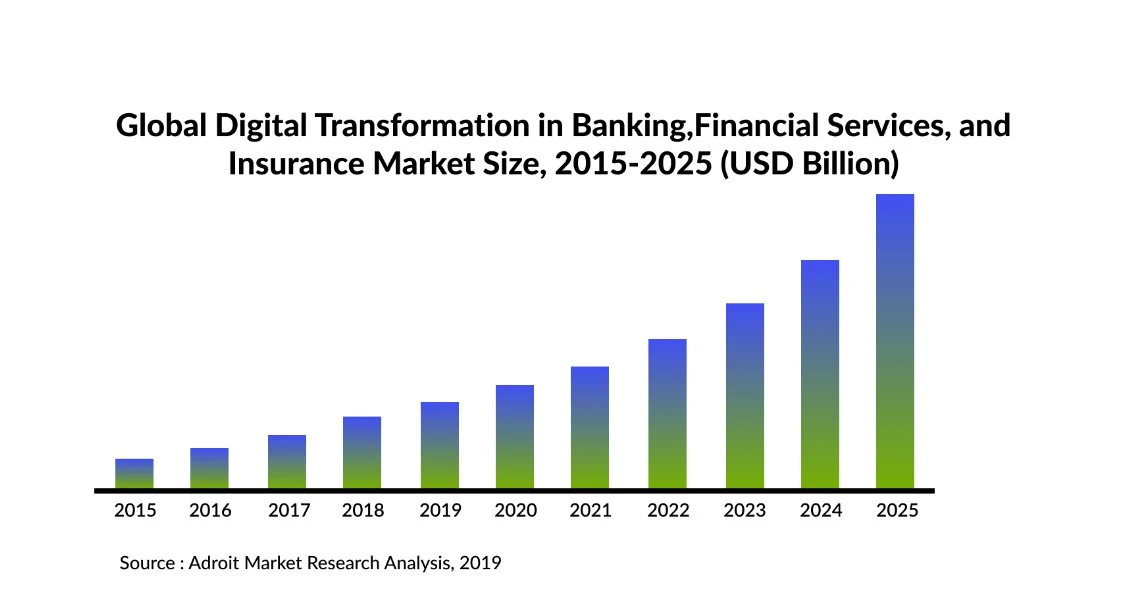

As technology continues to advance at an unprecedented pace, numerous companies across various industries are embarking on a journey toward complete digitalization. This transformative process is not limited to a specific sector or region, as even the American market, renowned for its diverse range of conservative niche companies, is now standing at the threshold of this significant transformation.

Many American companies have relied on traditional business models and practices that have served them well for decades. However, the rapid evolution of technology and the changing demands of consumers have necessitated a shift towards digitalization. This shift involves the integration of digital technologies and strategies into every aspect of a company’s operations, from customer interactions to internal processes.

One of the key drivers behind this digitalization trend is the increasing reliance on digital platforms and online channels for conducting business. With the rise of e-commerce, social media, and mobile applications, companies recognize the need to establish a strong online presence to remain competitive. This means developing user-friendly websites, optimizing for search engines, and leveraging social media platforms to engage with customers and drive sales.

By implementing digital tools and automation, companies can reduce manual processes, eliminate paperwork, and enhance productivity. This not only saves time and resources but also allows employees to focus on more strategic tasks that add value to the business.

Additionally, digitalization enables companies to gather and analyze vast amounts of data, providing valuable insights into customer behavior, market trends, and operational performance. By leveraging data analytics and artificial intelligence, companies can make data-driven decisions, personalize customer experiences, and identify new business opportunities.

At Digicode, we don’t just propel businesses forward. The journey isn’t just about embracing change but about the imperative for businesses to adapt or risk obsolescence, making our case both relevant and inevitable. In the marathon of digital transformation, Digicode emerges not only as a guide but a strategic partner, steering businesses toward a digital future.

How can businesses determine if they need to undergo digital transformation?

Signs for the need of digital transformation include outdated systems, inefficient processes, declining customer satisfaction, and difficulties in adapting to market changes. An assessment of technology, processes, and customer expectations can help identify the need for transformation.

What challenges are commonly associated with digital transformation?

Challenges include resistance to change, legacy system integration, data security concerns, and the need for cultural shifts within the organization. Overcoming these challenges requires strategic planning, effective communication, and a commitment to continuous learning.

How does digital transformation impact customer experiences?

Digital transformation enhances customer experiences by providing seamless interactions across online platforms, personalized services, and quick issue resolutions. It enables businesses to better understand and respond to customer needs, leading to increased satisfaction and loyalty.

How long does a typical digital transformation process take?

The duration of digital transformation varies based on the scope and complexity of changes. It can take several months to years, depending on factors such as the size of the organization, the extent of technology integration, and the level of cultural shift required.

What is the role of data analytics in digital transformation?

Data analytics plays a central role in digital transformation by providing insights for informed decision-making. Businesses can leverage analytics to understand customer behavior, optimize operations, and identify new opportunities, driving more strategic and data-driven initiatives.

Related Articles